Within Employee maintenance, previously the Super Annual Extra Amount field was modifiable and allowed users to enter values but with changes implemented by the ATO STP Phase 2 reporting requirements this field will no longer be editable meaning users will need to capture this value within Payroll Entry.

As this is a new change, it requires 2 new Pay Allocations to be created within Pay Allocation Maintenance.

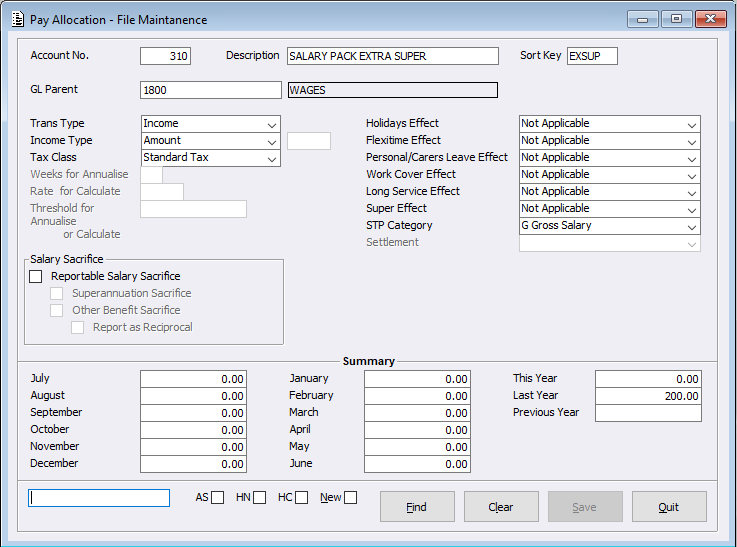

It is our suggestion only that the first Pay Allocation be set up as shown below:

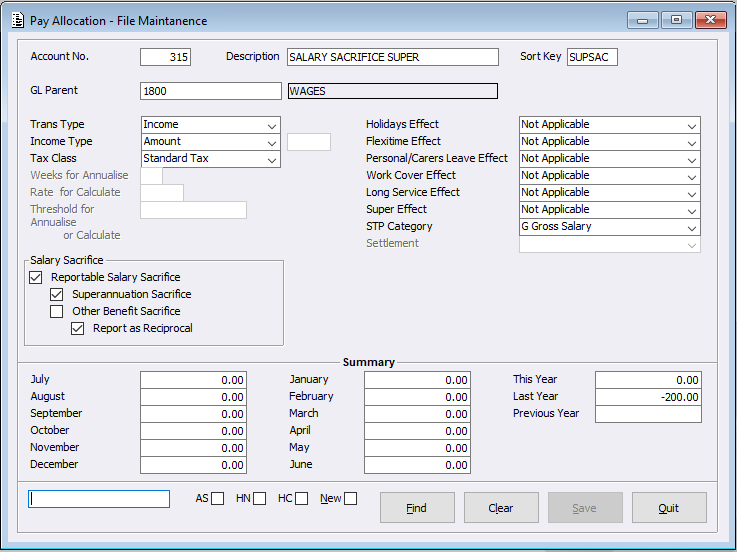

It is our suggestion only that the second Pay Allocation be set up as shown below:

Once created, you will need to process the amount through a Payroll Entry.

Within Payroll Entry, after selecting the employee, enter the first line which should be the first Pay Allocation with a positive value entered, then enter the Second line should be the second Pay Allocation with the same value entered but as a negative value. Include Tax and Settlement lines as usual.

By entering the values this way using the created Pay Allocations, when the system reports this to the ATO it will show the Income value of the first line and then a Salary Sacrifice value for the second line.

It should be noted that the STP category should be changed where necessary ie – in this scenario where it is a bonus for an employee, the STP category would be bonuses commissions etc